What's New? - May 2022

May is finally here, and with another month comes another exciting development for Report Toaster.

Tax Reports

Helping a few of our merchants compile their data as they struggled through the tax season gave us an idea - we really needed our own dedicated section for tax reports inside Report Toaster.

After all, we already had a lot of the necessary data, and the combination of our adjustable filters, columns, date ranges and sorting options makes it easy to compile the necessary sales data (no matter where you're filing).

You can find these reports in the new Taxes section here:

Note - You must be on a paid plan of Report Toaster to access these tax reports. You can read more about our different pricing plans here.

These reports consist of the following:

Taxes by Jurisdiction

This report is a breakdown of Sales with one line per jurisdiction, including columns for Orders, Shipping, Net Sales, Rate and the amount of Tax withheld.

It's a great report to have if you're looking for an overview of how much tax you paid where, and can be further filtered to suit your particular store's tax needs (e.g. limited to certain states, changing the date range and so on).

The breakdown for each of these columns is as follows:

Title - The name of the tax jurisdiction for which tax was withheld.

Rate - The tax rate for that particular jurisdiction.

Order Tax Lines - The number of taxable orders for that jurisdiction.

Price - The amount of tax withheld.

Net Sales - The taxable sales for the jurisdiction. Note that many tax authorities will ask for the gross sales (which to them means the amount collected, not including taxes). This is equivalent to the Net Sales field in Shopify.

Shipping - The amount charged for shipping on taxable sales. Some tax jurisdictions require tax to be collected on shipping charges. In this case, the Net Sales and Shipping columns would need to be added together to represent all taxable sales.

Monthly Taxable/Non-Taxable Sales

These two reports are essentially both sides of the same coin, namely, a month-by-month Sales Summary that uses a filter to limit the results to Taxable/Non-Taxable Sales respectively.

Both of these reports are fantastic for when you just need a high-level overview of your Sales data, with the number of applicable orders, taxes, Net Sales and Shipping displayed accordingly.

Some tax jurisdictions require that you report the Sales that were NOT taxed as well, so for this, the Non-Taxable Sales report is great so you have a point of comparison.

Some tax jurisdictions require that you report the Sales that were NOT taxed as well, so for this, the Non-Taxable Sales report is great so you have a point of comparison.

Like all of our reports, these can have filters added, columns adjusted, and have the date range/sorting altered to suit your needs. See our main guide here for more information.

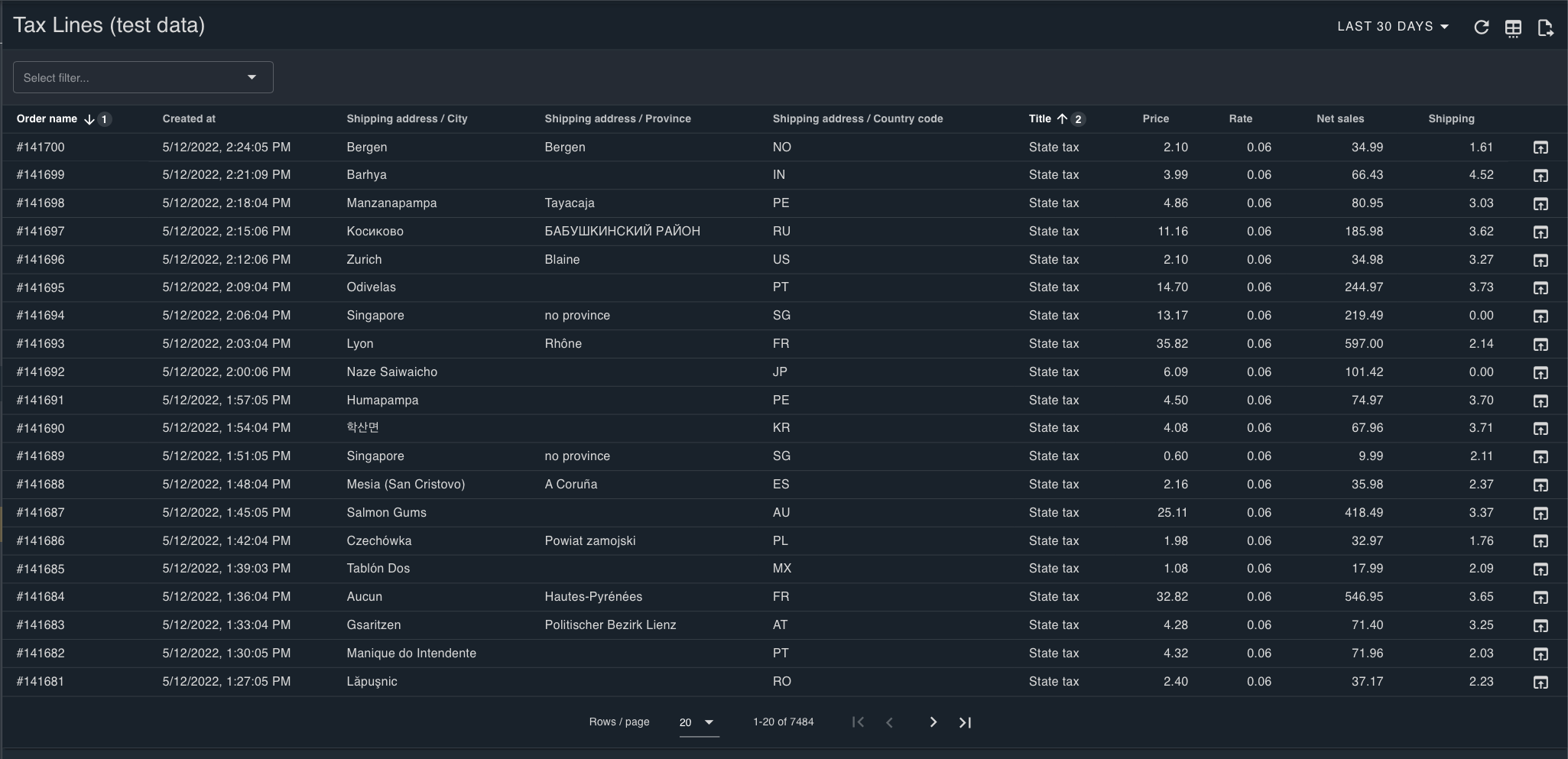

Tax Lines

This report provides a breakdown of Sales with one line per order, including columns for Shipping, Net Sales, Rate and the amount of Tax withheld.

Most of the time, reporting requirements will focus on the totals for a given period (last month, last quarter etc).

However, sometimes it's useful to have a report that breaks down the taxes on a per-order basis, so you can troubleshoot your data and make sure all of your taxes were calculated correctly.

However, sometimes it's useful to have a report that breaks down the taxes on a per-order basis, so you can troubleshoot your data and make sure all of your taxes were calculated correctly.

For more information on these reports and how to customize them for your particular business, check out our main guide in the knowledge base here.

Remember that you must be on a paid plan of Report Toaster to access these tax reports. If you'd like to learn more about our different pricing plans, check out our app listing here.

That's it for today, but keep an eye on this space as we announce more features and further developments in the future.

Until next time!

Related Articles

Taxes - Frequently Asked Questions

We get a lot of tax-related questions on our support chat, so in the interest of sharing that knowledge with the wider Report Toaster community, we thought it was time we compiled an FAQ for all questions pertaining to taxes. Note - A good place to ...Whats New? - February 2024

Moving into February, it's time to go over a few new (and improved) reports we've made available in Report Toaster! US Tax Thresholds This report is useful for merchants who collect sales taxes in the United States and want to see where their sales ...What's New? - December 2022

Rounding out the end of the year, it's time for our last update for 2022. We know it's been a really busy for most (hopefully all?) of you, and no doubt the holiday sales have been both hectic & exciting! As usual, we've been hard at work behind ...Whats New? - August 2023

It's August, and this month, we're here to talk about some improvements to a few of our reports! Updated Tax Reports We've released a new Tax model that allows us to make some key improvements to our existing suite of tax reports. There are a number ...Whats New? - April 2025

Another month is here, and this time we'll be taking a look at some of the new fields we've added to some existing reports in Report Toaster. Let's take a look! Channel Liable A popular request from merchants who sell on multiple marketplaces ...

Suggestion Box

Suggestion Box

Didn't find what you were looking for in our knowledge base? Click here to suggest an article, and we'll try to put something together for you.